Horizon ERP Tutorial

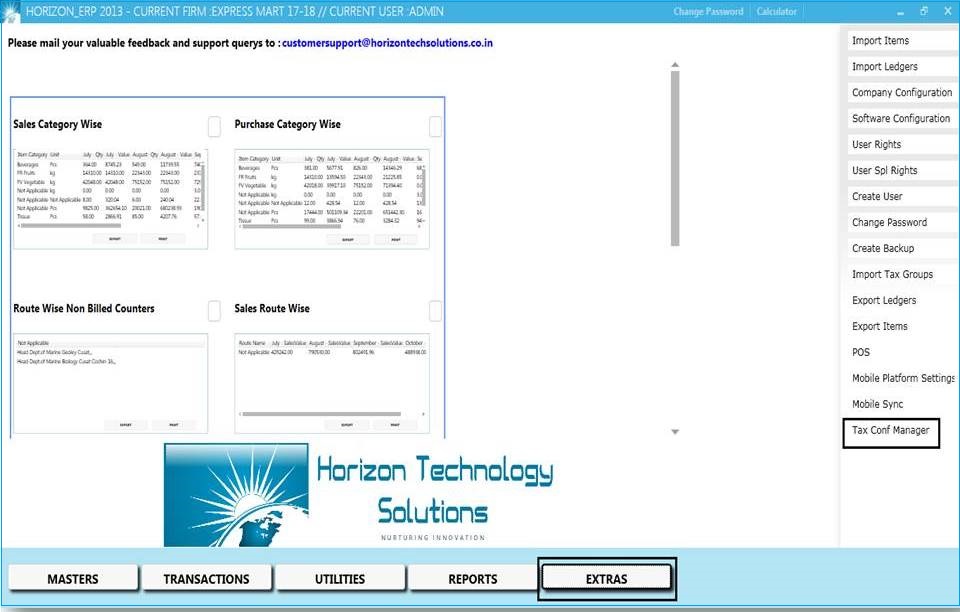

Extras

Tax Configuration Manager

Step 1:

Extras → Tax Conf Manager

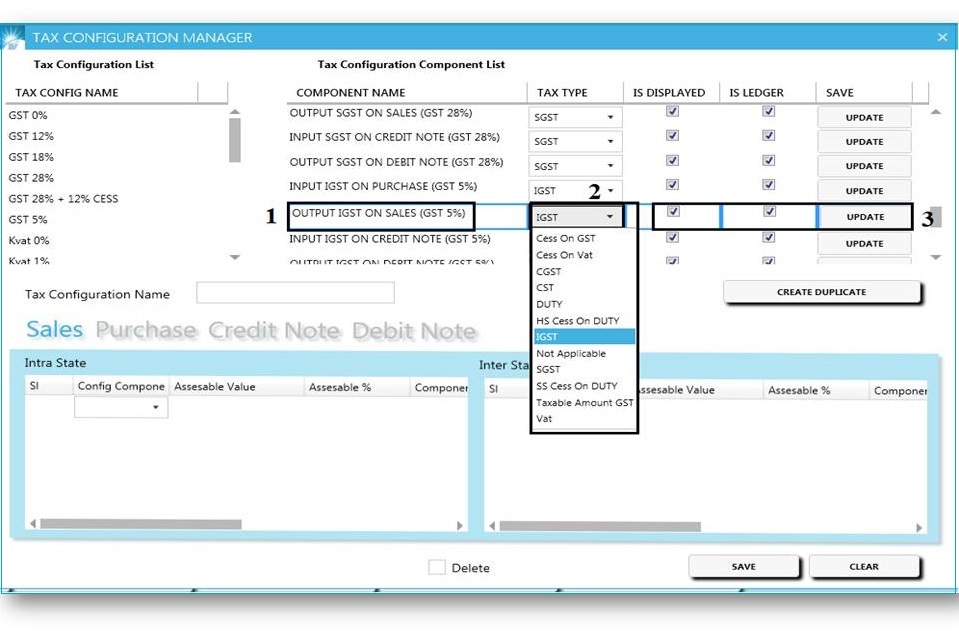

Step 2:

- Enter the Tax configuration component name.

- Select Tax type from the list.

- Click on save button and then the box displayed as "component has been saved" then click ok.

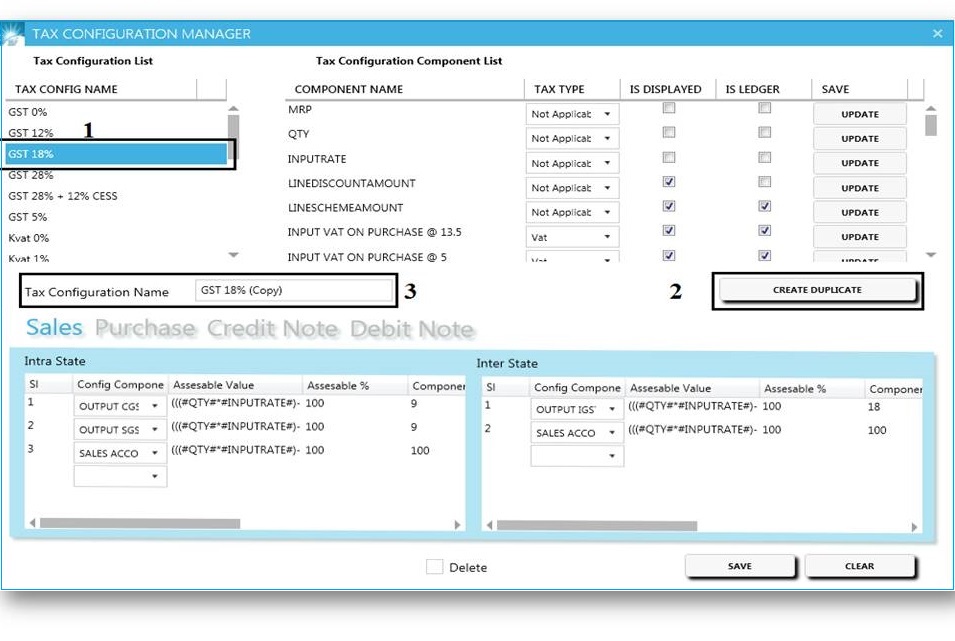

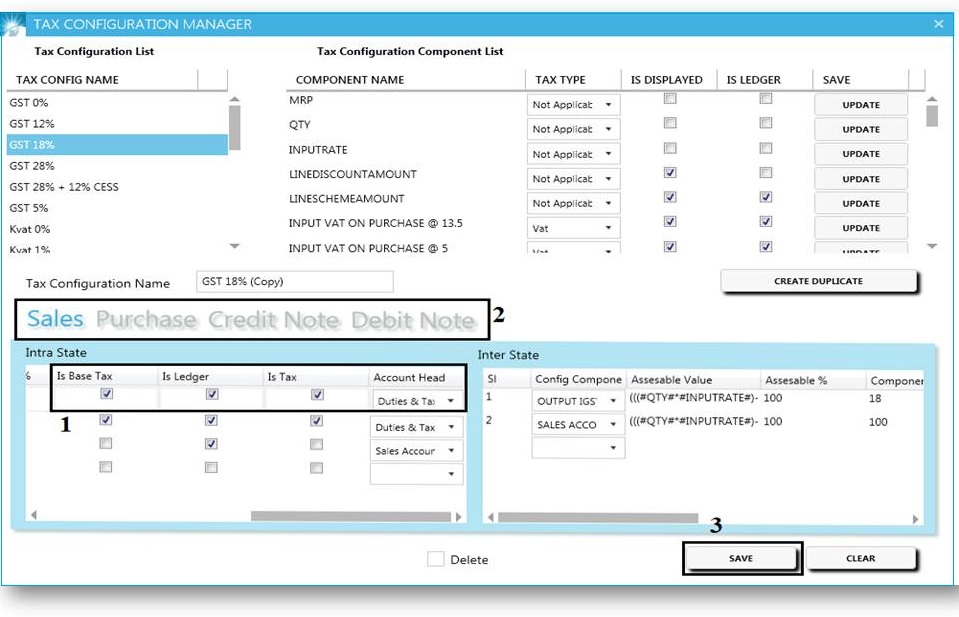

Step 3:

- Select tax config name → Press enter key.

- Click on "Create Duplicate".

- Here we can see the duplicate tax configuration name

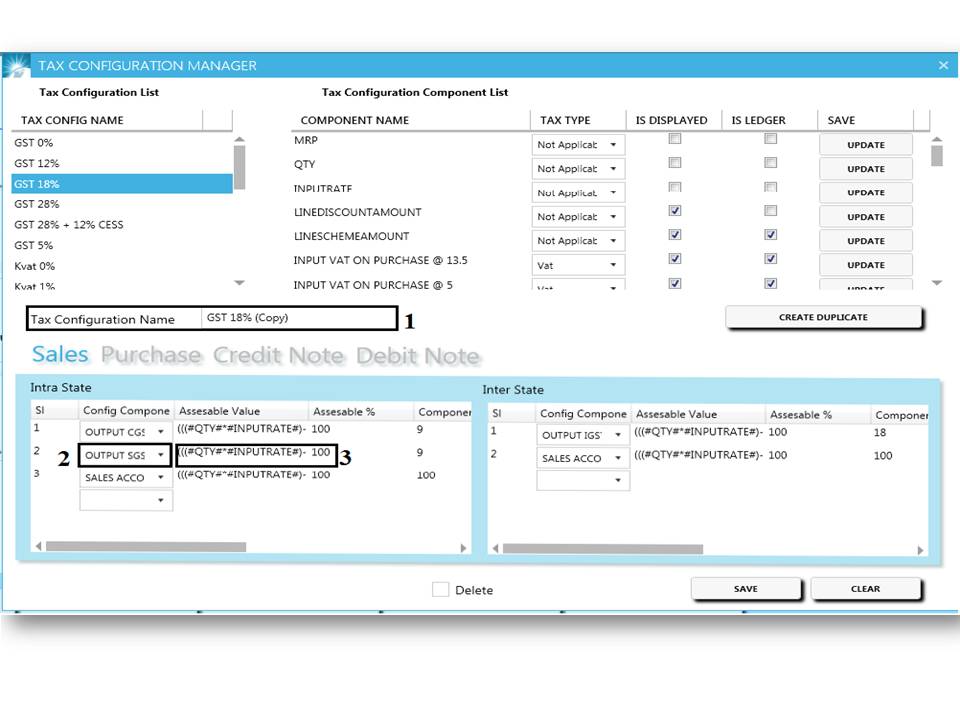

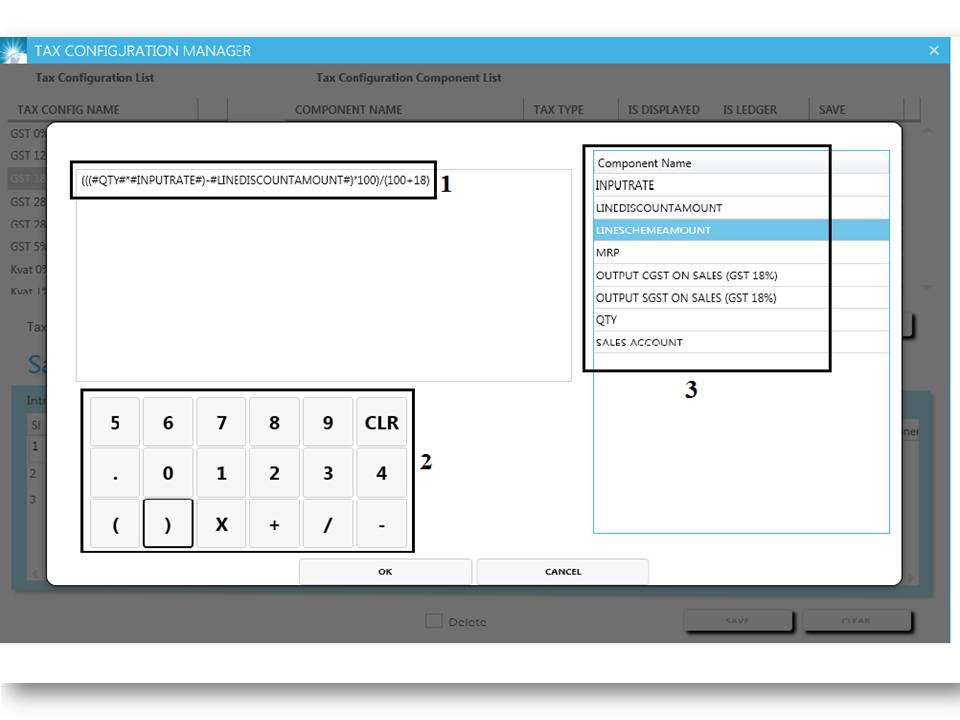

Step 4:

- Edit the tax configuration name.

- Select the config component from the list.

- Set the calculation for config component – click "F2" for edit the field.

- Set the component % for SGST,CGST,IGST & CESS.

- The window displayed while click on "F2" , and here we can set the calculation.

- Enter the equation.

- Use this keyboard for enter the value.

- Select component from the list.

- GST billing software-Tax Config Manager Ledger Part.

- Do the same for purchase, credit note, debit note.

- Click on save.