Horizon ERP Tutorial

Transactions

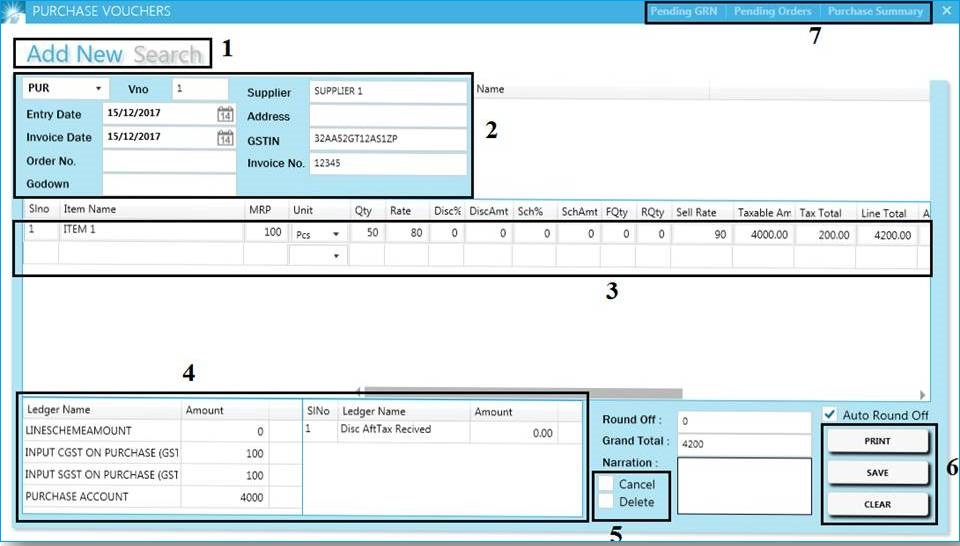

Purchase

- Purchase the products for the purpose of sale in the ordinary business.

- It is a kind of expense and hence included in the income statement within the cost of goods sold.

- Purchases may include buying of raw materials in case of manufacturing unit or finished goods in case of a retail business.

- Add new & Search : Add new purchase entry and View and edit already entered vouchers using search option

- Series : Mandatory field. Already created in Masters → series.

- Entry date and invoice date are mandatory.

- Entry Date : Date on which the invoice has been received.

- Invoice date : Input the date as given on the supplier invoice.

- Godown : Select godown, for the item stock added in to a particular stock point. [Godown created in Masters → Godown]

- Supplier : To be selected from the list on the right.

- GSTIN : Suppliers GST number will appear here automatically when that set it to,Masters → Suppliers.

- Invoice no. : Input Invoice number as per the invoice number received from suppliers.

- Item Field : Select items from the list as per the given invoice and also input the other fields.

- Current MRP as per the supplier invoice is to be inputted enabling the application to create new

batches to maintain MRP wise stock.

Gross Value =Rate * Quantity

Taxable amount = [(Gross Value) – Disc% / Discamt] - Case / outer calculations while selecting the unit;

- If selected unit is "CASES" input case rate.

- If selected unit is "OUTER" input outer rate.

- If selected unit is "Base Unit" (e.g. Pcs, Kg etc )input unit rate.

E.g. If 1case= 6 outer, 1outer = 12pcs.

Total number of Pcs = 6x12.

And the Discount & scheme calculations following this;

Discount % amount;Discount % amount = Gross Value * Disc%

Discount Total;Discount Total = Discount% amount + Discount amount

Scheme % amount;Scheme% amount = Taxable amount * Scheme%

Scheme total;Scheme total = Scheme% amount + Scheme amount

Line Total = (Taxable Amount + Tax Amount) - Scheme Total

Tax Amount = Taxable Amount * Tax Config% Selling rate = Landing cost + (Landing cost * sales margin%) - How to delete item in transactions?

- Select item → press delete key on the keyboard.

- Ledger and amount : Shows the accounting breakups of the inputted invoice.

- Discount after tax : Discounts inputted here will reflect only in the grand total.

- Cancel/ Delete : Tick for Cancel or delete and click update to delete or cancel the voucher.

- Print : To Generate a purchase invoice print.

- Save : To Save the purchase voucher.

- Clear : Reset the screen

- Pending GRN : Shows if any GRN entries are there to converted to purchase.

- Pending Orders : List of pending orders for which purchase invoice has not converted to purchase. Purchase order are generated in Transactions → Purchase order.

- Purchase Summary : Shows all recent purchase entries.