Horizon ERP Tutorial

Distribution in Horizon ERP

Success of a distribution business requires effective management of the entire distribution process.

It involves Order management, Inventory Management, Deliveries and Credit Management

Process flow of Distribution Management in Horizon ERP

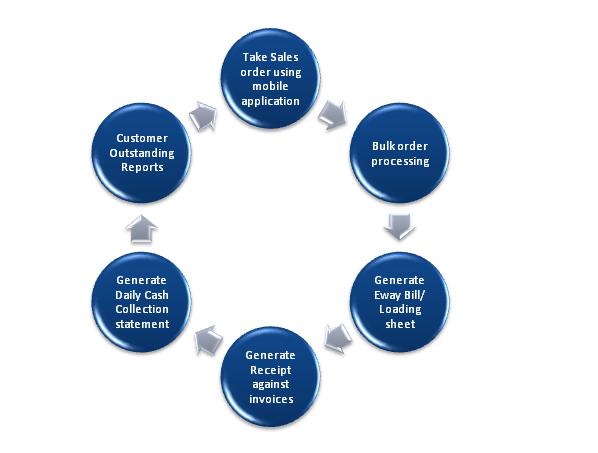

Outward Supply Process

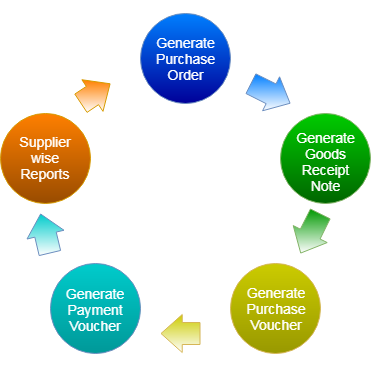

Inward Supply Process

Brief Overview of Distribution Management in Horizon ERP

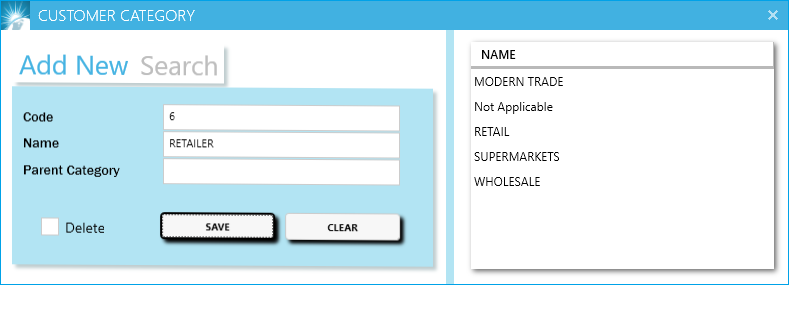

- Customer Category / Group Creation: Categorizing and grouping of customers on the basis of offtake, Credit worthiness etc. For generating informative reports

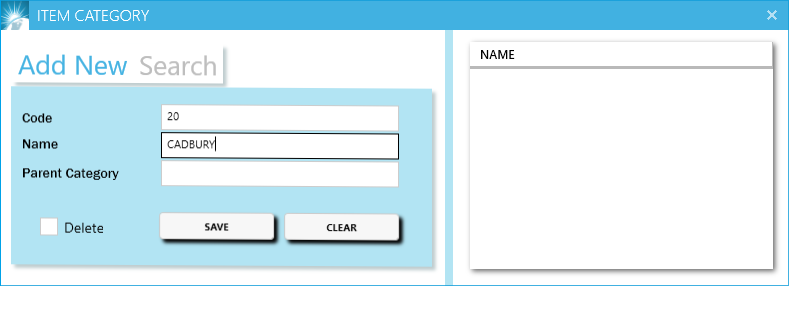

- Enter the Group/Category name and Save.

- Masters → Customer Category

- Masters → Customer Group

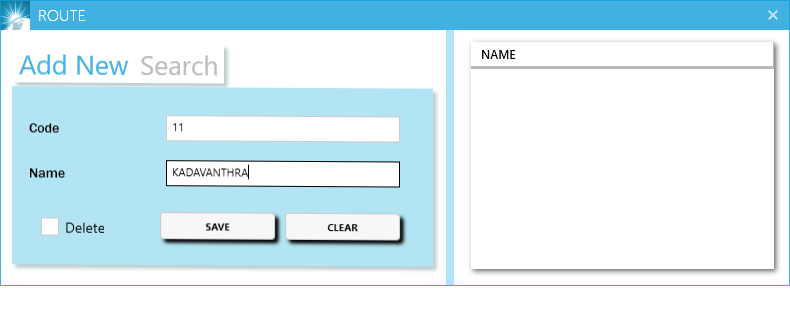

- Area/Route Creation: Segregation of customers on the basis of their geographical location. It very helpful charting supply routes and assigning outlets to different sales personnel

- Route wise order taking

- Area/Route wise outstanding reports

- Route wise collection statements

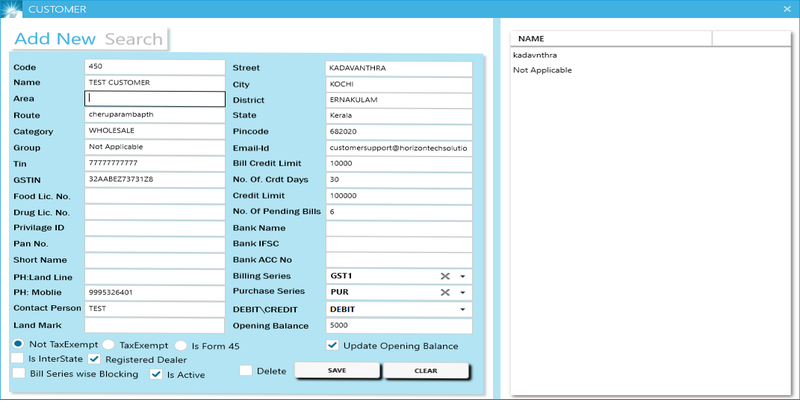

- Customer Creation: Customers or 'Sundry Debtors' are entities or individuals who buy materials or avail services of your enterprise

- Route, Area, Customer Category, Customer Group to be selected from the auto populated list on the right side of the window.

- Enter GST No. and Tick on "Registered Dealer" at the bottom of the window in case of customers with a valid GST registration.

- Enter "Email Id" to send invoices to the customer via email

- Select "State". If the customer state is interstate, tick on "Is InterState"

- Set credit limits of a customer, it will helps to managing the maximum credit that can be availed by a customer.

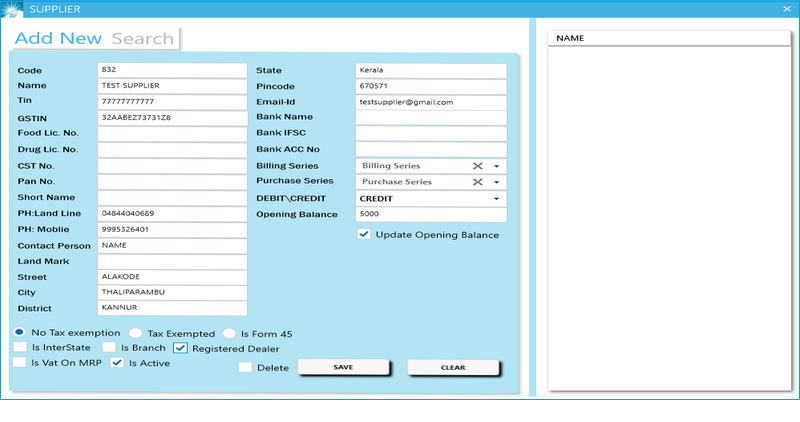

- Supplier Creation: Those who supply goods or services are called suppliers/ Sundry creditors.

- Item Category / Group Creation

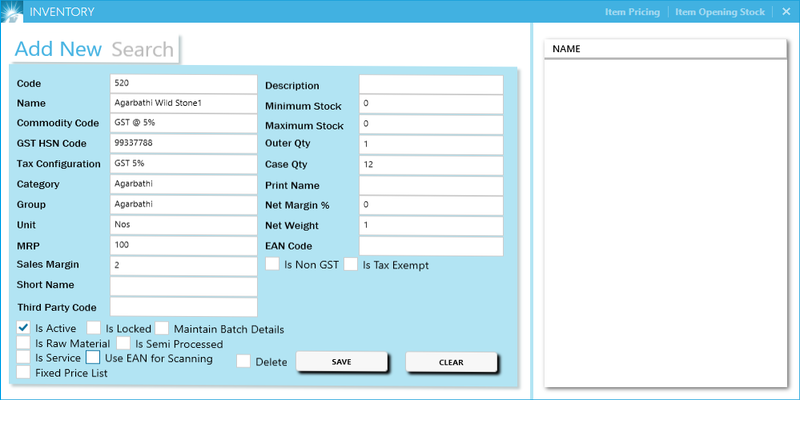

- Item Creation: Defining of Products or services being handled by your business

- Product name, Commodity code, Tax configuration, HSN code and unit are mandatory fields

- If products are sold in individual units as well bulk cases, use the 'case qty' field to update the number of units per case

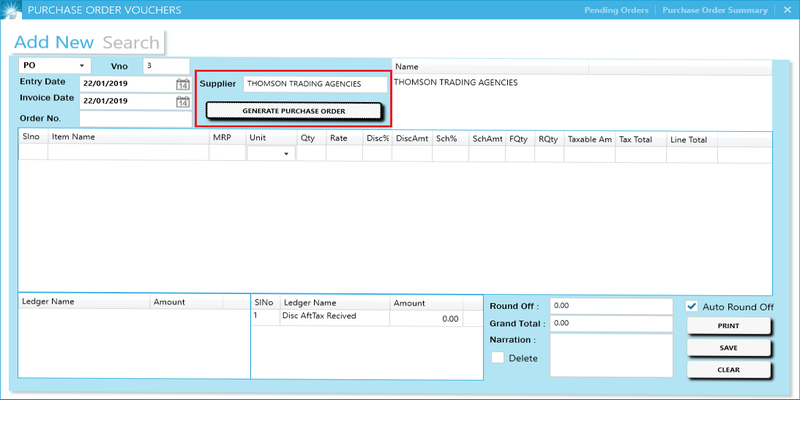

- Purchase order voucher creation: Create a voucher that is issued by the buyer to a seller, containing information pertaining to the goods that are required.

- Select supplier and click on "Generate Purchase order".

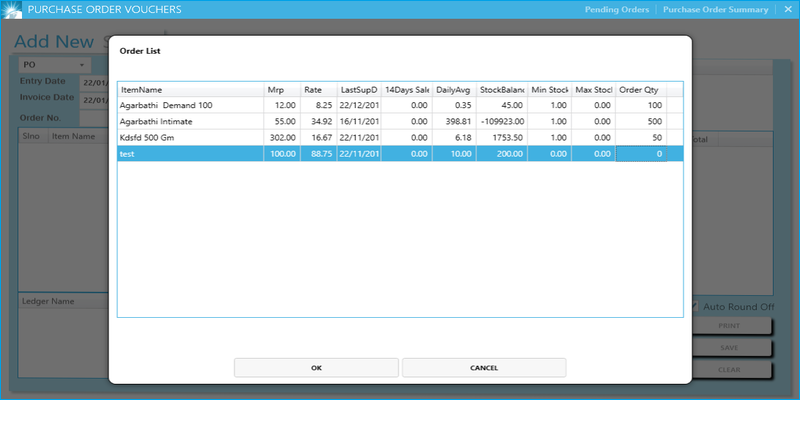

- Update the quantities required for in the displayed order list. Please note the order list is generated for items that have already been purchased from the vendor.

- Enter the order qty for the items wants to purchase. If the stocks already exist, enter the order qty as 0 → Click ok → Save the voucher

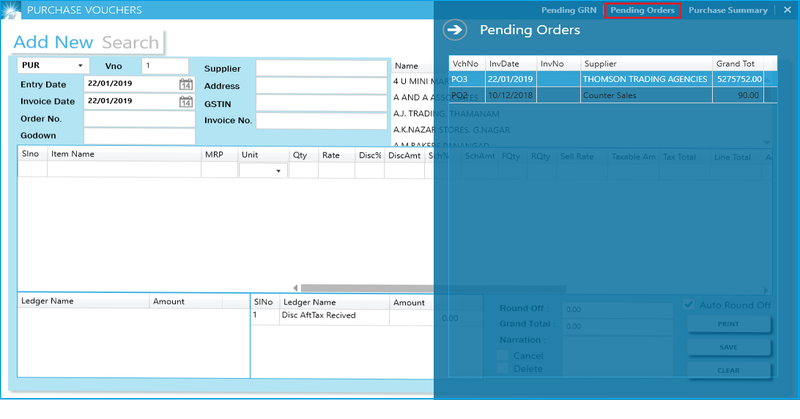

- Purchase Voucher Creation: Generate Purchase based on the purchase invoice that given by the seller.

- Click on "Pending orders" at the top right of the purchase voucher for purchase order processing.

- Payment Voucher Creation: Generate payment voucher against the purchase

- Select the supplier and enter the amount

- Choose payment method. If selected bank, enter the transaction details for the reference.

- Sales order Voucher creation: Take sales order using Horizon mobile order application

- Horizon Mobility to sync data into software

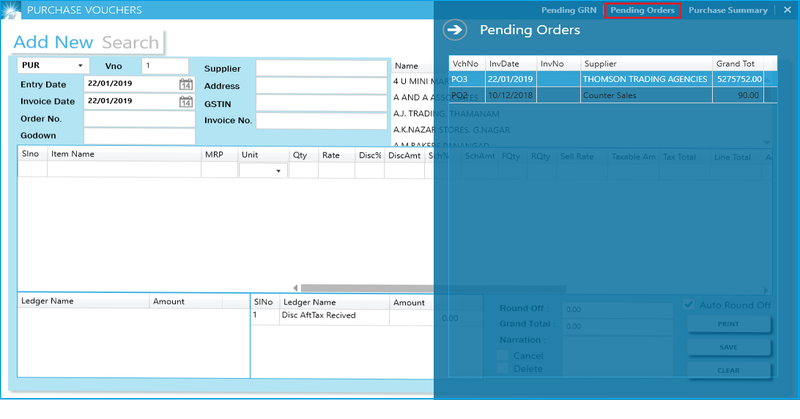

- Sales order bulk processing – Can edit order details here → and then click on "Save". Orders will be converting to sales.

- Turn on "Print" option to save and print all the orders.

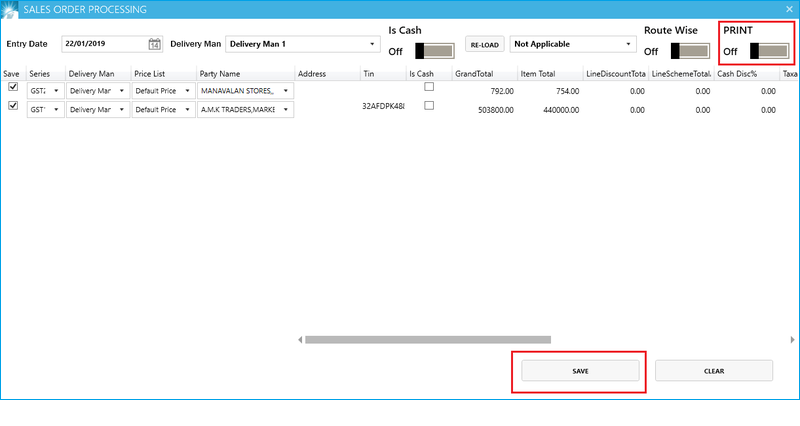

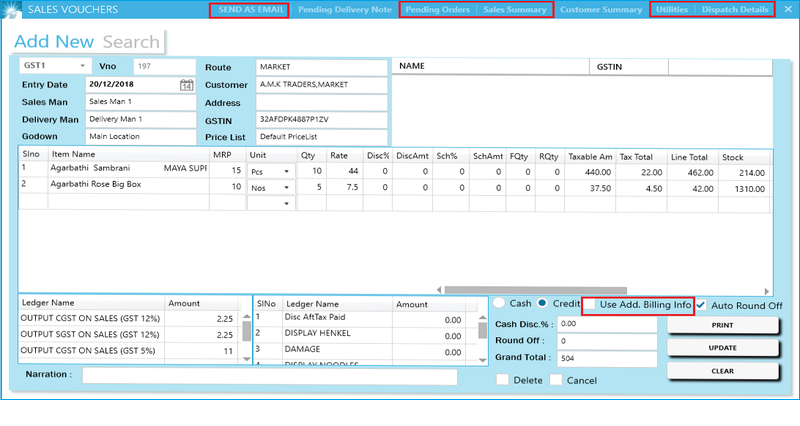

- Sales Voucher Creation: Sales orders will be converted to sales after completing the sales order processing (Step 10).

- Click on "Pending Orders" to Convert sales order to sales one by one.

- Utilities → Multiple Bill Print - Can take multiple bill print at a time

- Dispatch Details – For entering delivery details.

- Can Email the invoices to the customers (Click on "Send As Email" at the top left of the sales window)

- "Use Addl.Billing Info" for adding shipping address (at the bottom right of the sales window)

- Choose Payment Method Cash/Credit

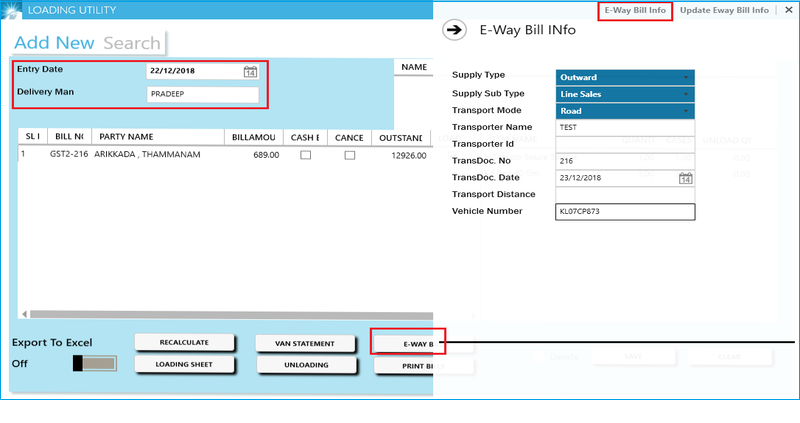

- E-Way Bill: Generate E-Way bill if the invoice amount greater than 50,000

- Select Bill date and Delivery man

- Displayed all bill under the selected date and delivery man

- Update E-way bill info and click on E-Way Bill button for generate JSON file.

- JSON file will be saved in c drive and upload JSON file into E-Way Bill site

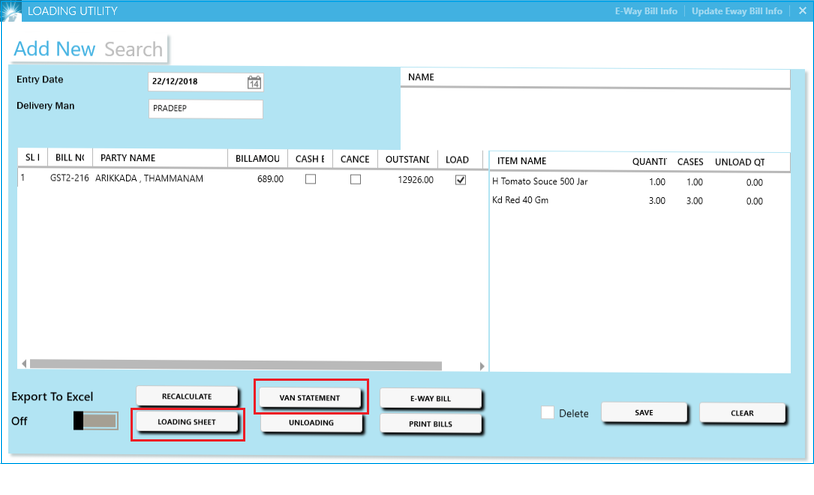

- Loading Sheet/Van statement: In case invoice amount less than 50,000, use Loading sheet / Van statement for loading process.

- Select Bill date and Delivery man

- Displayed all bill under the selected date and delivery man

- Click on Loading sheet / Van statement

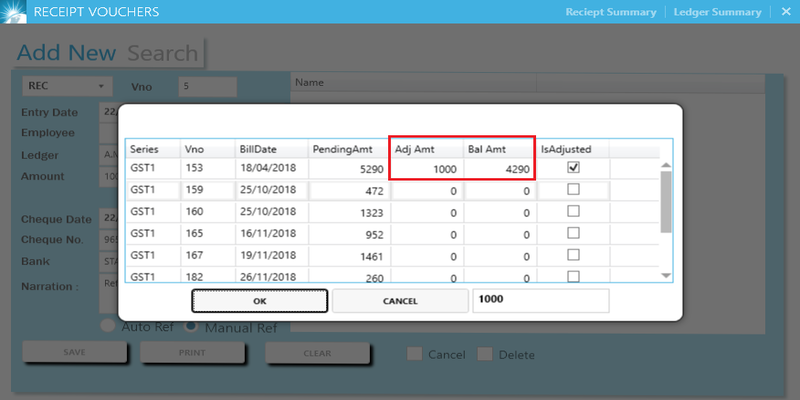

- Receipt Voucher Creation: Enter receipt against sales voucher.

- Can process the receipts through Horizon Mobile order App.

- For manual entry, select the ledger name and enter the amount.

- Select payment method cash/Bank. If bank, enter the other details for reference.

- Auto Reference – The amount will be deducted from the first outstanding.

- Manual Reference – The amount will be deducted against the selected bill only.

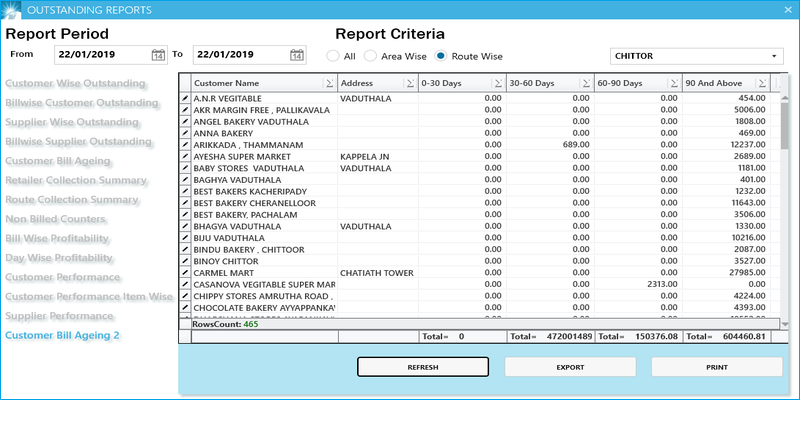

- Outstanding Reports

- Customer wise and Bill wise outstanding reports

- Supplier Wise reports

- Bill wise profitability reports

- Customer Bill ageing reports

- Route wise collection summary

- Non Billed counters

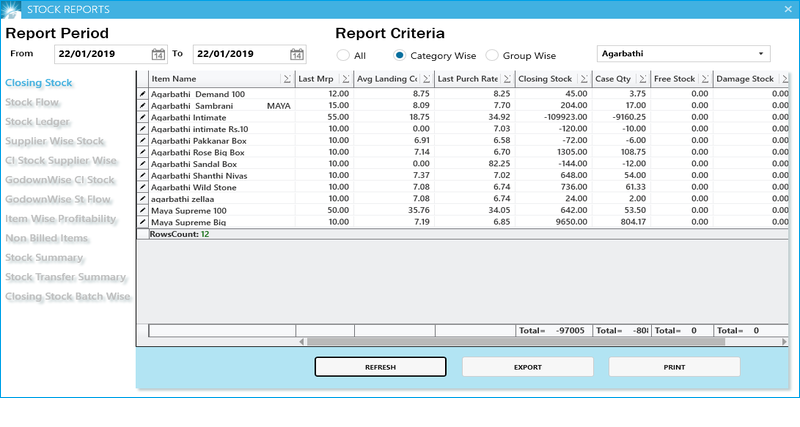

- Stock Reports

- Closing stock report

- Stock flow

- Item wise profitability

- Non Billed items

- Godown wise stock

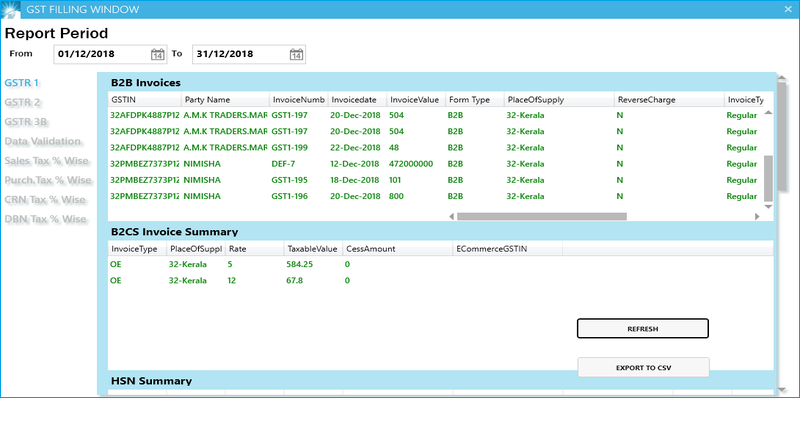

- GST Reports:

- GSTR 1 - Report can export as csv format for GSTR1 filing.

- GSTR 2

- GSTR 3B

- Data Validation – If there are any errors in the transaction the same will be displayed here.

- Tax % wise reports of all transactions